Alumni EMBA Part Time finance finanza startup

When finance rhymes with innovation. Welfin introduces itself

An idea, project work, a startup: Welfin’s story progressed from the classrooms of MIP to the financial market thanks to its strong innovative imprint. It will be the first P2P loan platform with credit guaranteed by a company to be launched on the market. Its founders tell about the project.

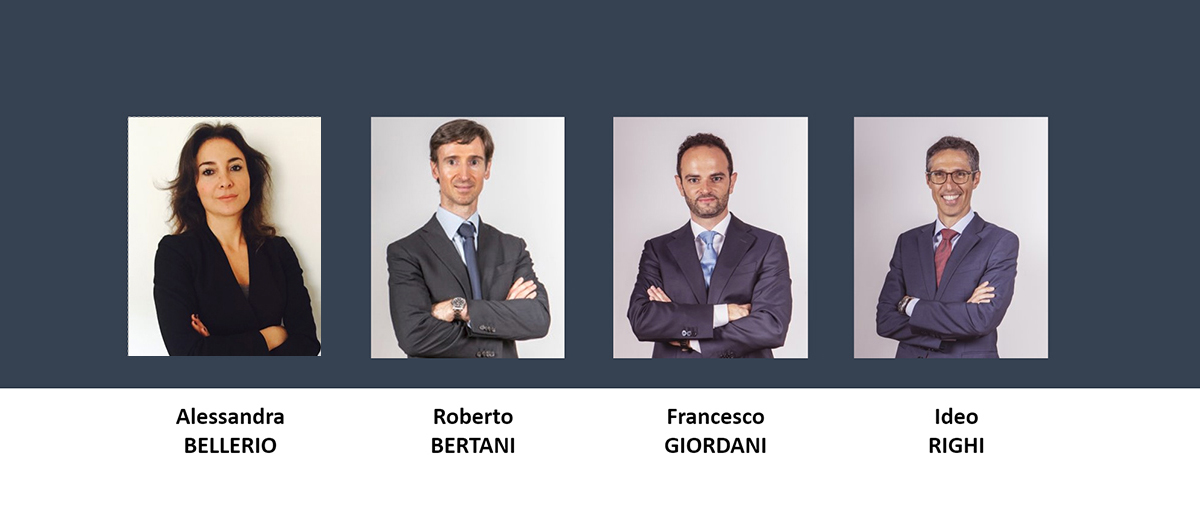

«In Italy the consumer credit market is constantly expanding and P2P (peer to peer) loans continue to have great potential». Why not start from this and rethink credit between private players in a new intra and inter-corporate perspective? This is the reflection from which Ideo Righi, Francesco Giordani, Alessandra Bellerio and Roberto Bertani, founders of Welfin, as well as 2018 Part-time EMBA alumni, began.

Welfin is a platform that revolutionizes credit between employees, allowing one or more company communities to obtain the maximum from sharing their resources. In the words of its five founders, «Welfin brings together lender, borrower and company (acting as guarantor) by promoting the creation of favourable conditions for all players involved». Let’s take a closer look.

A business model in which all parties are in agreement

In a consumer credit market with interest rates that tend towards the high side, credit concession policies on the part of companies are often cautious and the cost of debt collection expensive. «Welfin steps in, creating a virtuous circle that rewards the three players involved, lender, borrower and company, through a win-win-win system» explains Francesco. «Win for the lender, because they have a guaranteed return from the company at above-market rates; win for the borrower because they also obtain favourable rates and win for the company, which acting as a guarantor, increases the sense of belonging of its employees and improves its reputation», continues Alessandra. «Welfin offers the company a new welfare instrument with which to optimize the management of outstanding credit, creating a shared economic benefit by focusing on financial innovation – stresses Ideo -. There are already many entrepreneurs who, aware of the efficiency of Welfin’s business model, want to implement the platform as soon as possible».

Genesis and development of Welfin. From project work to the choice of “doing business”

But what was the starting point? «The observation of an entrepreneurial reality suffering from the insolvency of its employees towards consumer credit institutions allowed us to study a system that could help all parties involved, from the company to employees. We therefore identified a need and devised a solution» explains Ideo. For Alessandra, «the key values that inspired Welfin were ethics, transparency and usefulness for employees». It’s an idea that was first project work for the 2018 Part-time EMBA and then – thanks to the trust and success achieved – became a startup. «When we realized its potential, we decided to “do business”» says Francesco. «We choose each other inside the classroom of the master’s programme, and we created a close-knit, cross-cutting team, with previous business experience and thus a clear perception of risks. A team whose members are on the same wavelength, both in terms of personal and professional growth», comments Alessandra.

Finance awards sustainable innovation

Welfin won the “Fintech & Insurtech 2019” Prize, set up by the Observatory of Politecnico di Milano, for the most innovative projects in the financial field. What were its winning attributes? «A brand-new business model that is able to innovate the financial sector in a sustainable and intelligent way» its creators say. «Thanks to the recognition obtained we’ll begin a period of innovation through PoliHub, at the same time as developing all the aspects necessary to go to market, from tax to legal ones, so as to be ready at the official kick-off».

The company has also begun a dialogue with the Bank of Italy. «We carried out an initial assessment of the regulatory compliance of the business model. An experience that allowed us to confirm and offered food for thought to make it to the go to market phase even more prepared», according to Francesco, Alessandra and Ideo, who conclude by illustrating the role MIP had in this experience and its strengths: «Its network, the professionalism of professors and the enormous support in all phases of product development. The master’s programme guaranteed us an entrepreneurial, highly pragmatic and interactive experience and was also an incubator of talent and open-mindedness for the business application models and leadership development. And we believe Welfin’s business model could be even more effective in the Covid-19 recovery period, when in the face of increased obstacles for consumer credit access, it will provide support for families and individual workers in difficulty».

All there’s left to do is to (re)start.